GA Hard Money Lenders: The Best Option for Fast and Flexible Real Estate Loans

GA Hard Money Lenders: The Best Option for Fast and Flexible Real Estate Loans

Blog Article

The Ultimate Overview to Discovering the Ideal Tough Money Lenders

Browsing the landscape of difficult money lending can be a complicated venture, calling for an extensive understanding of the various aspects that contribute to a successful borrowing experience. From reviewing lenders' reputations to contrasting rates of interest and costs, each action plays an important duty in securing the very best terms possible. In addition, developing efficient communication and offering a well-structured organization plan can dramatically influence your interactions with lenders. As you consider these variables, it becomes noticeable that the path to identifying the ideal tough money lender is not as uncomplicated as it might appear. What crucial insights could additionally boost your method?

Comprehending Tough Money Lendings

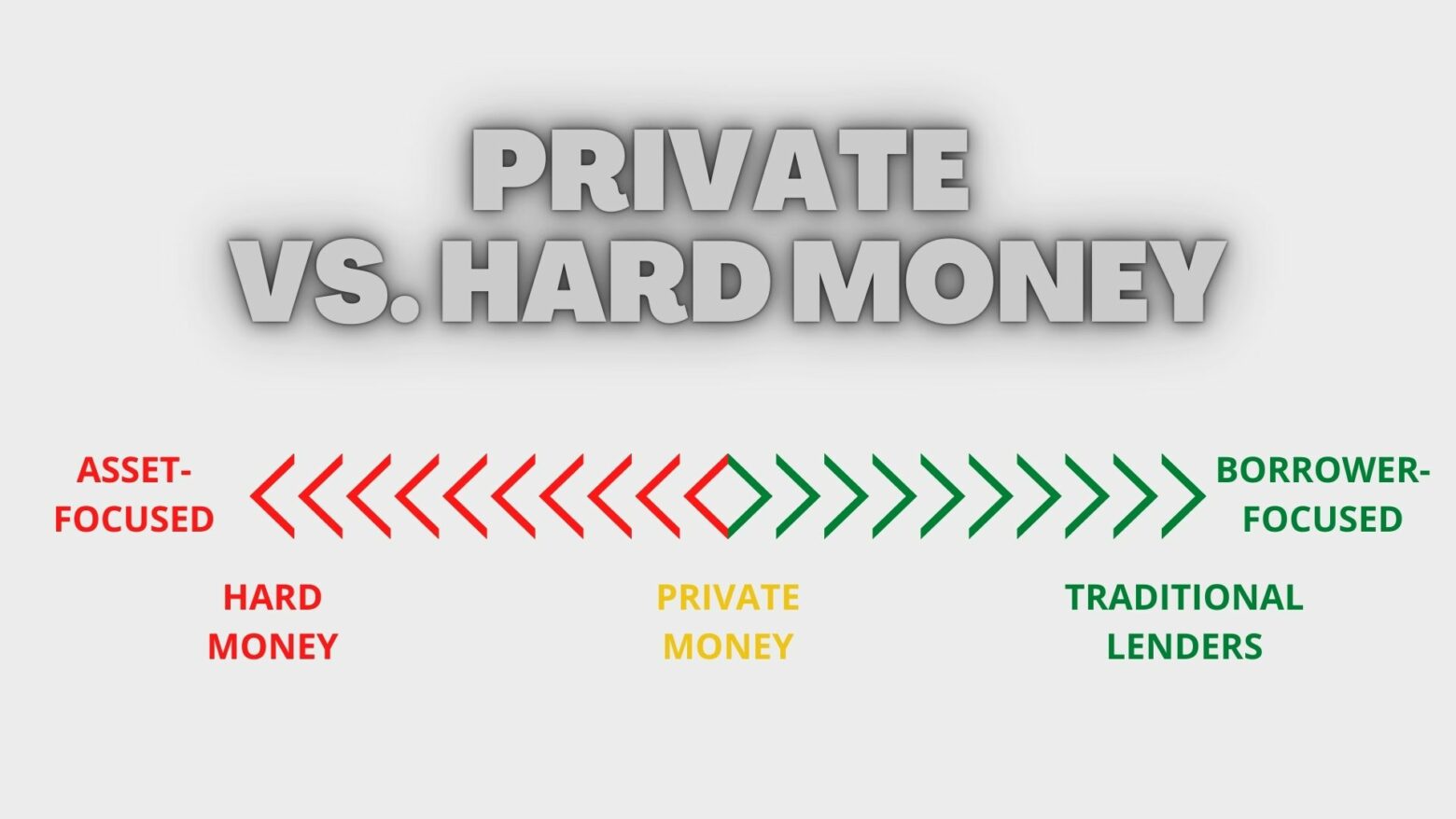

One of the specifying functions of hard money finances is their reliance on the value of the residential property as opposed to the debtor's credit reliability. This enables borrowers with less-than-perfect credit or those looking for expedited funding to accessibility resources more readily. Additionally, hard money car loans normally feature greater rate of interest and shorter payment terms contrasted to conventional finances, showing the increased risk taken by lending institutions.

These car loans serve different objectives, including funding fix-and-flip projects, refinancing troubled residential properties, or giving capital for time-sensitive chances. Comprehending the nuances of tough money loans is crucial for investors that intend to take advantage of these economic instruments effectively in their genuine estate ventures (ga hard money lenders).

Secret Aspects to Take Into Consideration

Next, take into consideration the terms of the loan. Different loan providers provide varying rate of interest, charges, and payment timetables. It is vital to recognize these terms completely to stay clear of any type of undesirable surprises later. Additionally, take a look at the lender's funding rate; a speedy approval process can be vital in affordable markets.

One more essential variable is the loan provider's experience in your particular market. A lending institution accustomed to local conditions can provide important insights and could be much more adaptable in their underwriting procedure.

How to Examine Lenders

Evaluating difficult cash lenders entails a methodical strategy to ensure you select a companion that straightens with your financial investment goals. Begin by evaluating the loan provider's track record within the sector. Search for reviews, reviews, and any kind of available scores from previous customers. A reliable lending institution should have a background of effective purchases and a solid network of satisfied consumers.

Following, examine the lending institution's experience and specialization. Various lenders might concentrate on various kinds visit of residential properties, such as residential, commercial, or fix-and-flip jobs. Pick a lender whose know-how matches your investment method, as this expertise can significantly influence the approval procedure and terms.

Another critical factor is the loan provider's responsiveness and interaction design. A reliable lender needs to be ready and accessible to answer your concerns comprehensively. Clear communication during the analysis process can suggest how they will manage your loan throughout its period.

Finally, ensure that the lender is clear regarding their processes and requirements. This includes a clear understanding of the documentation required, timelines, and internet any kind of conditions that may apply. When picking a difficult cash loan provider., taking the time to examine these facets will certainly encourage you to make an informed choice.

Comparing Rates Of Interest and Fees

An extensive contrast of interest rates and charges amongst hard money lenders is vital for optimizing your financial investment returns. Hard money fundings frequently feature greater rates of interest compared to typical funding, normally varying from 7% to 15%. Understanding these prices will certainly assist you examine the prospective prices associated with your financial investment.

In addition to passion prices, it is critical to evaluate the linked costs, which can considerably impact the overall finance price. These charges may include origination charges, underwriting charges, and closing prices, often expressed as a percent of the funding amount. For circumstances, source costs can differ from 1% to 3%, and some lenders may bill extra costs for handling or management tasks.

When comparing loan providers, think about the total expense of borrowing, which includes both the rates of interest and charges. This all natural strategy will allow you to determine one of the most affordable alternatives. In addition, make certain to ask about any feasible early repayment fines, as these can impact your capability to settle the financing early without incurring additional fees. Eventually, a cautious analysis of rates of interest and costs will result in more educated loaning choices.

Tips for Effective Loaning

Comprehending rate of interest and fees is just component of the formula for securing a tough money loan. ga hard money lenders. To ensure effective loaning, it is essential to extensively assess your economic situation and project the potential roi. When they comprehend the designated usage of the funds., Begin by plainly defining your loaning purpose; lenders are a lot more most likely to react favorably.

Following, prepare a comprehensive business strategy that outlines your job, anticipated timelines, and monetary projections. This shows to lending institutions that you have a well-thought-out approach, boosting your credibility. In addition, preserving a solid relationship with your loan provider can be advantageous; open interaction fosters trust and can cause a lot more favorable terms.

It is likewise important to make sure that your home fulfills the loan provider's criteria. Conduct a complete evaluation Click Here and supply all required documentation to simplify the approval process. Be mindful of departure strategies to pay back the finance, as a clear repayment plan assures loan providers of your dedication.

Final Thought

In summary, finding the very best difficult money loan providers requires a detailed evaluation of different aspects, including lender credibility, funding terms, and field of expertise in residential or commercial property types. Reliable analysis of lending institutions through comparisons of rate of interest and costs, combined with a clear business plan and solid interaction, improves the possibility of desirable borrowing experiences. Eventually, attentive study and calculated engagement with lending institutions can cause effective monetary results in actual estate ventures.

Furthermore, difficult money financings generally come with greater rate of interest prices and shorter settlement terms contrasted to conventional finances, showing the boosted risk taken by lending institutions.

Report this page